Implementation of GIS Technology For Property Tax Assessment

9 November 2018

MyTransfer Istanbul – VIP Airport Transfer

9 October 2025GIS Based Property Tax Application

Property tax stands as a pivotal revenue stream for local governments, underpinning the financial architecture that facilitates quintessential civic amenities ranging from healthcare and education to sanitation and infrastructural development. Recent scholarship, as delineated in a particular study, underscores that property tax revenue accounts for a mere 0.2% of India's total GDP. When juxtaposed against global benchmarks, this figure is strikingly modest. Developing nations typically see a contribution of around 0.7%, while in developed countries, this metric often escalates to 1.4% or more.

.

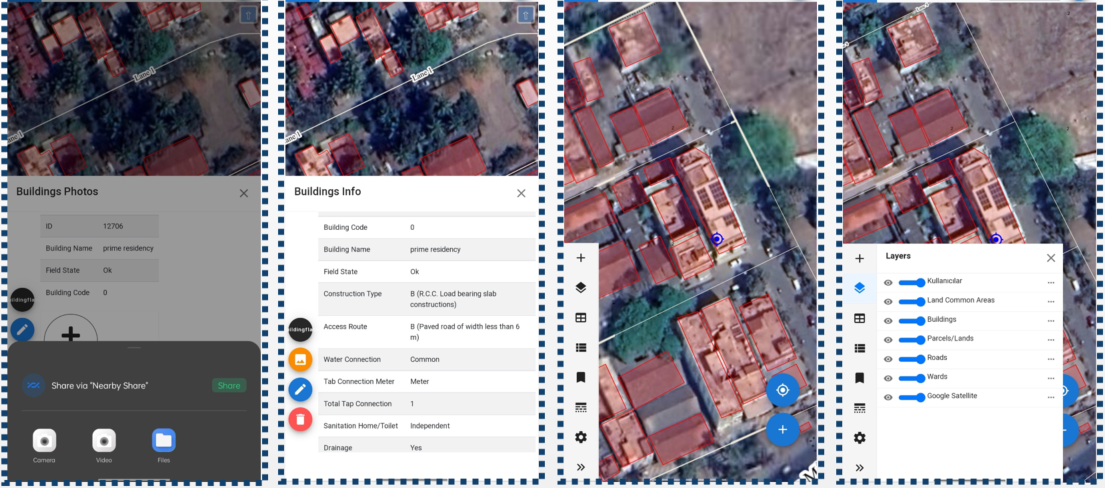

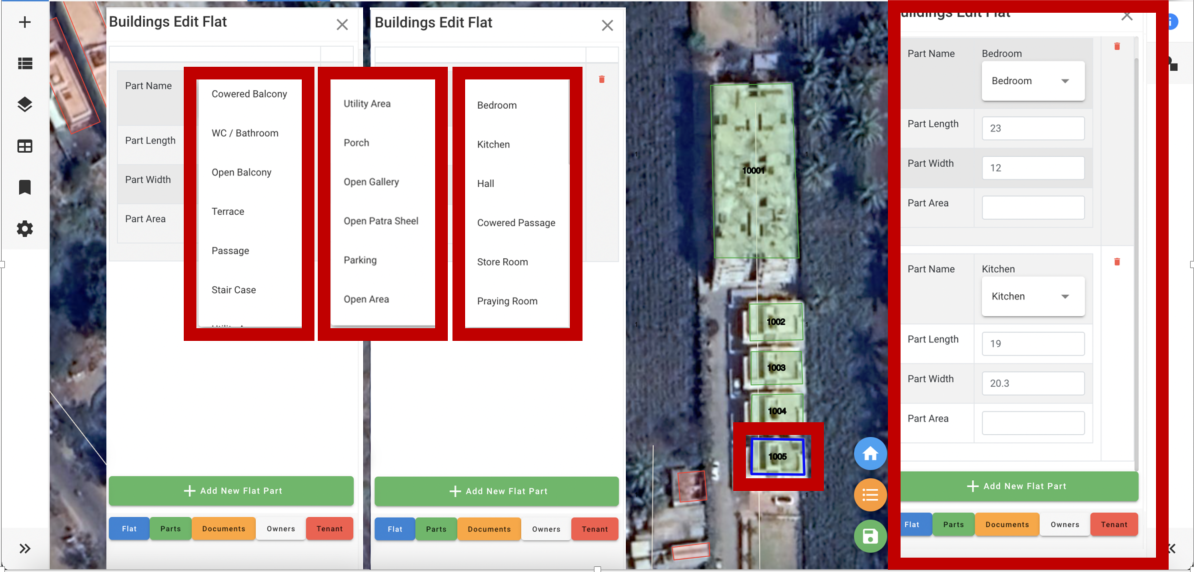

Property Tax application which is combined with GIS technologies and tax calculation software to give service as an end to end solution in property tax assessments projects. The purpose of the application is to create accurate and fulfilling solutions to be implemented to ULBs by creating a chance for digitalization of property tax system. The application is targeting to give solutions from site survey till property bill creation and reporting as a platform which lets multiple parties meet.

.

Challenges and Solutions

Challenges and Solutions

In India, the property tax market is faced with several challenges, including undervaluation, incomplete registers, policy inadequacy, ineffective administration, lack of accurate property tax rolls, and capacity constraints for smaller ULBs. As Mekansal India, we believe that implementing GIS-based property tax applications could offer a promising solution to these issues in the long term process.

- Undervaluation

- Incomplete registers

- Policy inadequacy

- Ineffective administration

- Lack of accurate property tax rolls

- Constraints in capacity, especially for smaller ULBs

The Need for GIS in Property Taxation

The Need for GIS in Property Taxation

This technology has the potential to revolutionize the real estate industry by providing accurate property valuation through precise digital mapping and data analysis, which helps to avoid errors and undervaluation. Furthermore, GIS enables efficient administration. To improve municipal management, it is recommended to streamline processes and optimize resource allocation. It is suggested to maximize revenue potential by improving tax assessment methods. To ensure reliable property information, it is recommended to move away from error-prone paper-based methods to enhance data accuracy. It is also suggested to implement enhanced security measures. Our company recommends implementing advanced security features to protect property data. Additionally, we suggest utilizing data analysis to make informed decisions and effectively implement changes. It is important to ensure fairness in taxation and promote community development initiatives.

The implementation of GIS-based property tax applications has the potential to significantly enhance revenue management practices and community service for municipalities.

Benefits of Using GIS for Property Taxation

Benefits of Using GIS for Property Taxation

In the realm of property taxation, integrating GIS brings a plenty of benefits. Firstly, it ensures unparalleled accuracy by eliminating human errors, guaranteeing precise property assessments. Secondly, it saves valuable time for assessment processes. Moreover, GIS fortifies against fraud with robust security measures, safeguarding against deceptive practices in property valuation. Additionally, it offers easy visualization options, simplifying complex property data through maps, charts, and graphs. Beyond these basics, GIS enhances public trust, streamlines workflows, and empowers better decision-making. Real-world case studies illustrate its transformative impact, while ongoing evolution promises continued refinement in the property taxation process. With GIS, property taxation undergoes a revolution, benefiting both officials and property owners alike.